Italy’s Atlantia, perhaps better known as highway operator Autostrade

per l’Italia, is expected to imminently be making an offer to buy

Spanish infrastructure business Abertis. One of the Abertis investments

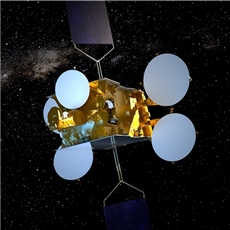

is a major 57 per cent stake in Spanish satellite operator Hispasat. The

overall deal is reportedly worth more than €15 billion, and in the

process, would create one of the world’s largest toll-road operators.

However, the other major shareholder in Hispasat is Eutelsat (33.69 per

cent), and the relationship between Hispasat and Eutelsat has been

somewhat strained following a July 2016 decision by Eutelsat to exercise

a “PUT” option – agreed with Hispasat/Abertis back in 2008 – and to

sell its stake in accordance with the 2008 agreement with an independent

valuation of its shareholding.

In June 2016 Eutelsat said it would exercise the option this coming July

as “the exercise of the ‘put’ represents a pre-agreed exception to a

lock-up period extending to the end of July 2017,” according to a

statement from Eutelsat at the time. Abertis responded by saying that

the ‘Put’ option was not valid.

Eutelsat CEO Rudolphe Belmer, speaking to analysts in July 2016, said:

“On Hispasat, we don’t have a clear view on the calendar, even though

it’s very clear in the shareholder agreement we have with our partners

in Hispasat. But for the moment, we cannot comment on specific dates [as

to when we will] receive the payments from Abertis. We have initiated,

as to the PUT process and together with the PUT process comes a process

of valuation of the company, which takes some time. The duration of the

process as described and signed in the shareholder agreements lasts

around three months.”

A year ago, the Eutelsat stake was valued at some €400 million.

In March 2017, the Spanish financial newspaper El Pais reported that Eutelsat was going to sell its stake in Hispasat to Abertis

|